1. This is the first significant reform of the U.S. tax code since 1986. Reagan signed major legislation for corporations and individuals in 1986

3. Changes have been made to both individual and corporate tax rates. Individual provisions in the new legislation technically expire by the end of 2025, though some people expect that a future Congress won’t actually let them lapse. Most of the corporate provisions are permanent.

4. The mortgage interest deduction has been lowered.

A. Current homeowners are in the clear. But from now on, anyone buying a new home will only be able to deduct the first $750,000 of their mortgage debt. That’s down from $1 million. For current homeowners: Deduction on 1,000,000 of principal still applies as long as there no cash out refinance.

B. Refinancing. Homeowners may refinance mortgage debts existing on 12/14/17 up to $1 million and still deduct the interest, so long as the new loan does not exceed the amount of the mortgage being refinanced.

C. Second Homes. Interest remains deductible on second homes, but subject to the $1 million / $750,000 limits.

5. Home sellers who turn a profit keep their tax break. Homeowners who sell their house for a gain will still be able to exclude up to $500,000 (or $250,000 for single filers) from capital gains, so long as they’re selling their primary home and have lived there for two of the past five years.

6. The deduction for moving expenses is gone. There may be some exceptions for members of the military. But most people will no longer be able to deduct the cost of their U-Haul when they move for work.

7. The corporate tax rate is coming down. The corporate tax rate has been cut from 35% to 21% starting next year. The alternative minimum tax for corporations has been thrown out altogether. Earnings are expected to go up as a result.

8. Almost everyone is now exempt from the estate tax. Before tax reform, few estates were subject to the estate tax, which applies to the transfer of property after someone dies. Now, even fewer people have to deal with it. The amount of money exempt from the tax — previously set at $5.49 million for individuals, and at $10.98 million for married couples — has been doubled.

9. Pass-through entities will also get a break. The tax burden by owners, partners and shareholders of S-corporations, LLCs and partnerships — who pay their share of the business’ taxes through their individual tax returns — has been lowered via a 20% deduction. The legislation includes a rule to ensure owners don’t game the system (compensation requirements), but tax experts remain concerned about abuse of this provision.

10. None of this will affect your 2017 taxes. Americans won’t need to worry about these changes when they start filing their 2017 tax returns in about a month. The new laws will first be applied to 2018 taxes.

11. Fewer people will have to deal with the alternative minimum tax. The alternative minimum tax, a parallel tax system that ensures people who receive a lot of tax breaks still pay some federal income taxes, remains in place for individuals. But fewer people will have to worry about calculating their tax liability under the AMT moving forward. The exemption has been raised to $70,300 for singles, and to $109,400 for married couples.

12. There are still seven tax brackets for individuals, but the rates have changed. Americans will continue to be placed in one of seven tax brackets based on their income. But the rates for some of these brackets have been lowered. The new rates are: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

13. The standard deduction has essentially been doubled. Lawmakers want fewer people to itemize their taxes. To achieve this, they’ve nearly doubled the standard deduction. For single filers, the standard deduction has increased from $6,350 to $12,000; for married couples filing jointly, it’s increased from $12,700 to $24,000.

14. The personal exemption is gone. Previously, you could claim a $4,050 personal exemption for yourself, your spouse and each of your dependents, which lowered your taxable income. No longer.

15. But say goodbye to the tax deduction for alimony payments. Alimony payments, which are codified in divorce agreements and go to the ex-spouse who earns less money, are no longer deductible for the person who writes the checks. This provision will apply to couples who sign divorce or separation paperwork after December 31, 2018.

16. The disaster deduction. Losses sustained due to a fire, storm, shipwreck or theft that aren’t covered by insurance used to be deductible, assuming they exceeded 10% of adjusted gross income. But now through 2025, people can only claim that deduction if they’ve been affected by an official national disaster. That would make someone whose house was destroyed by a California wildfire potentially eligible for some relief, while disqualifying the victim of a random house fire.

17. Adjustments for inflation will be slower. The new legislation uses “chained CPI” to measure inflation. It’s a slower measure than what was used before. Over time, that will raise more money for the federal government, but deductions, credits and exemptions will be worth less.

Please note the above information was compiled by Chaves & Perlowitz LLP through numerous websites and articles. Chaves & Perlowitz makes no representations or takes any responsibility for the accuracy of any information contained herein.

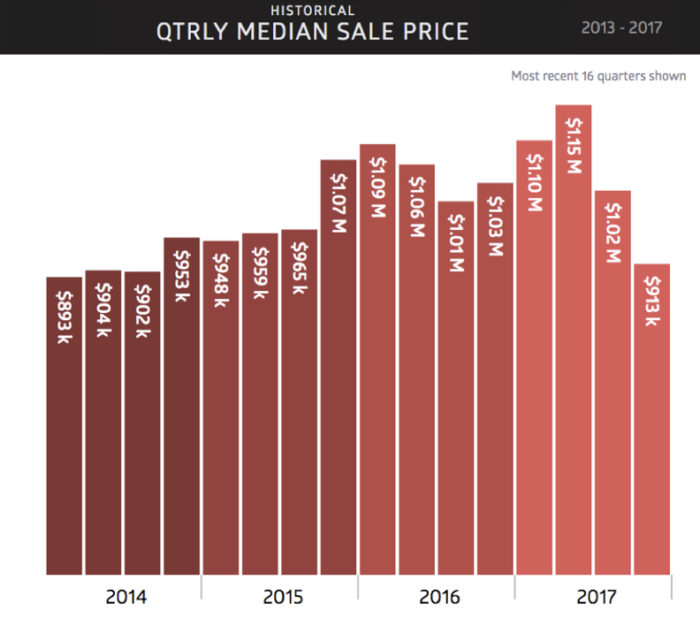

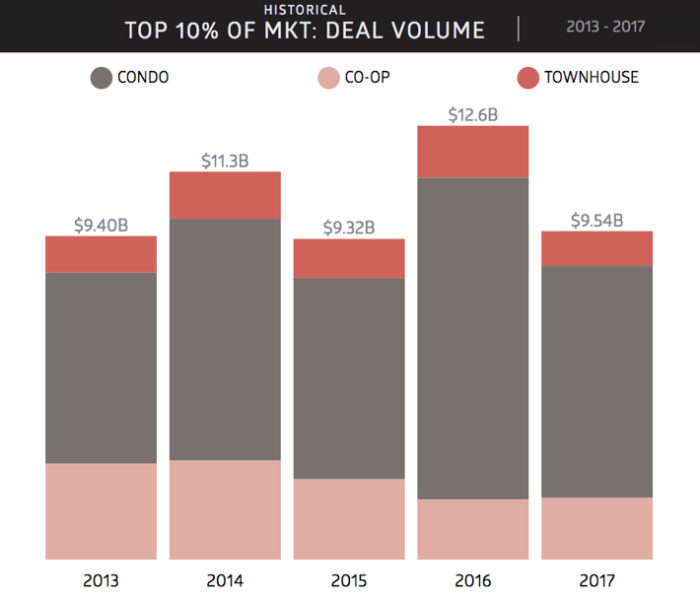

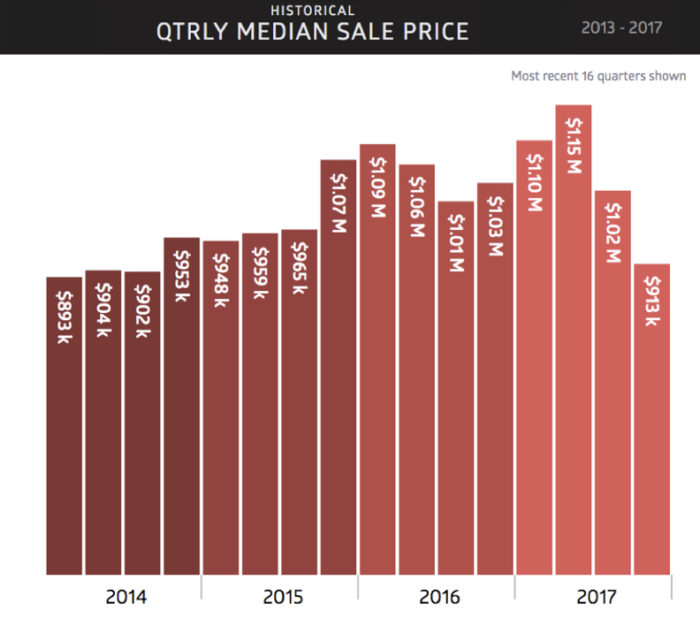

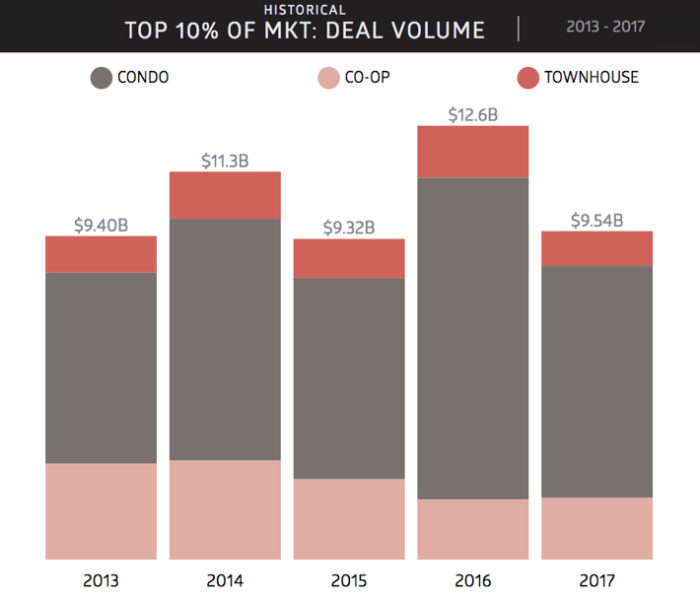

Our New York City real estate market faced (and overcame) many challenges during 2017. Although we spent the entire year managing downward price pressure in both the sales and rental markets, the market was active and saw a number of high profile sales. Those included big co-ops and major condos, especially at 432 Park and some of the marquee buildings in the Financial District. Overall, it has been a year for both buyers and sellers to adjust their expectation.

The year started out strong. After a slow fourth quarter in 2016, buyers stepped up in many price categories during the early part of the year. Although rentals were already slowing down as inventory from the many investor purchases saturated that market, we saw steady activity throughout the sales markets below $6 or $7 million. Activity remained strongest in the market below $2 million, but the mid-sized co-ops of 6, 7 and 8 rooms also enjoyed market strength and good prices, although typically without a plethora of showings. The buyers out there were both reasonable and serious!

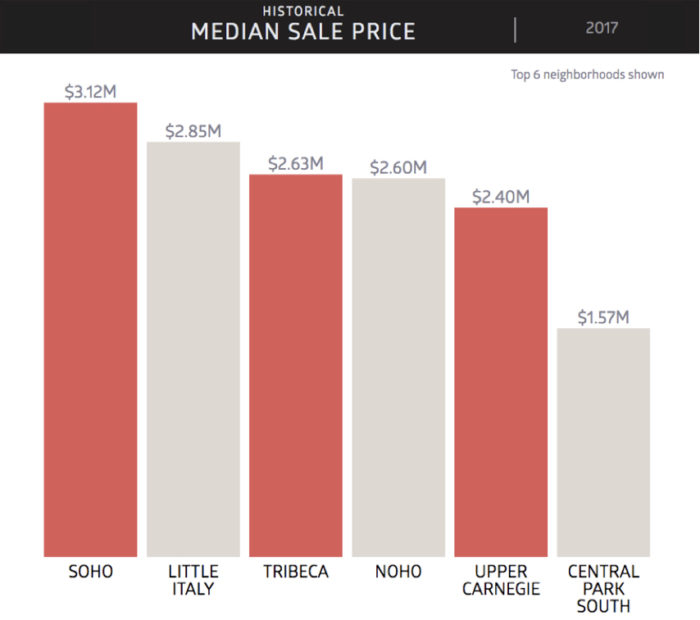

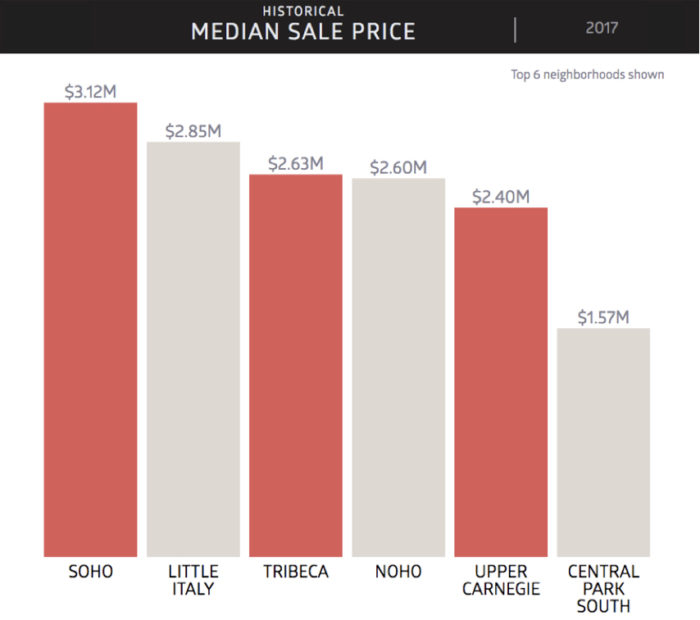

During these first few months of the year, ultra-high-end condo sponsors began quietly negotiating bigger discounts with promising buyers. The market for properties above $10 million seemed flooded with inventory, with another ultra-expensive penthouse seeming to appear on a different corner in NoHo or Nolita every week.

Even with negotiability, sales for the top new condos slowed considerably from their pace of the same quarter during the previous year. And as winter morphed into spring, the price malaise became more generalized.

Our spring market was uncharacteristically slow. No big influx of exciting new properties arrived on the market, but inventory continued to rise as properties remained for sale for increasingly lengthy periods of time. There were fewer big ticket sales, and the e-mail boxes of agents were crammed, day after day, with price reduction notifications coming from neighborhoods all over town. As we moved into summer it began to seem that sellers had heard the voice of the market: optimistic pricing does not sell property in 2017. Homes sold only when prices tied tightly to value, and when staging guaranteed that the property present the best possible appearance. And as more and more prices moved into the appropriate range, more apartments and houses which had lingered on the market were sold to buyers with realistic expectations. Those buyers who bid too low, like sellers who aimed too high, failed to secure their desired properties.

The pace of sales remained lackluster throughout the summer, with numerous co-op properties returned to the market by mysterious Board rejections. Then, after Labor Day, activity picked up. Even the high-end market was busier through September and October. As Thanksgiving approached, and debate about the Trump tax plan with its elimination of the deductibility of state and local taxes came to the fore, buyers began stepping to the sidelines. While we closed a number of large deals during the last weeks of the year, we also saw buyers backing away and a few even discussing dropping their deposits (although none of them did) as the full impact of the new laws on high tax states like New York became clear.

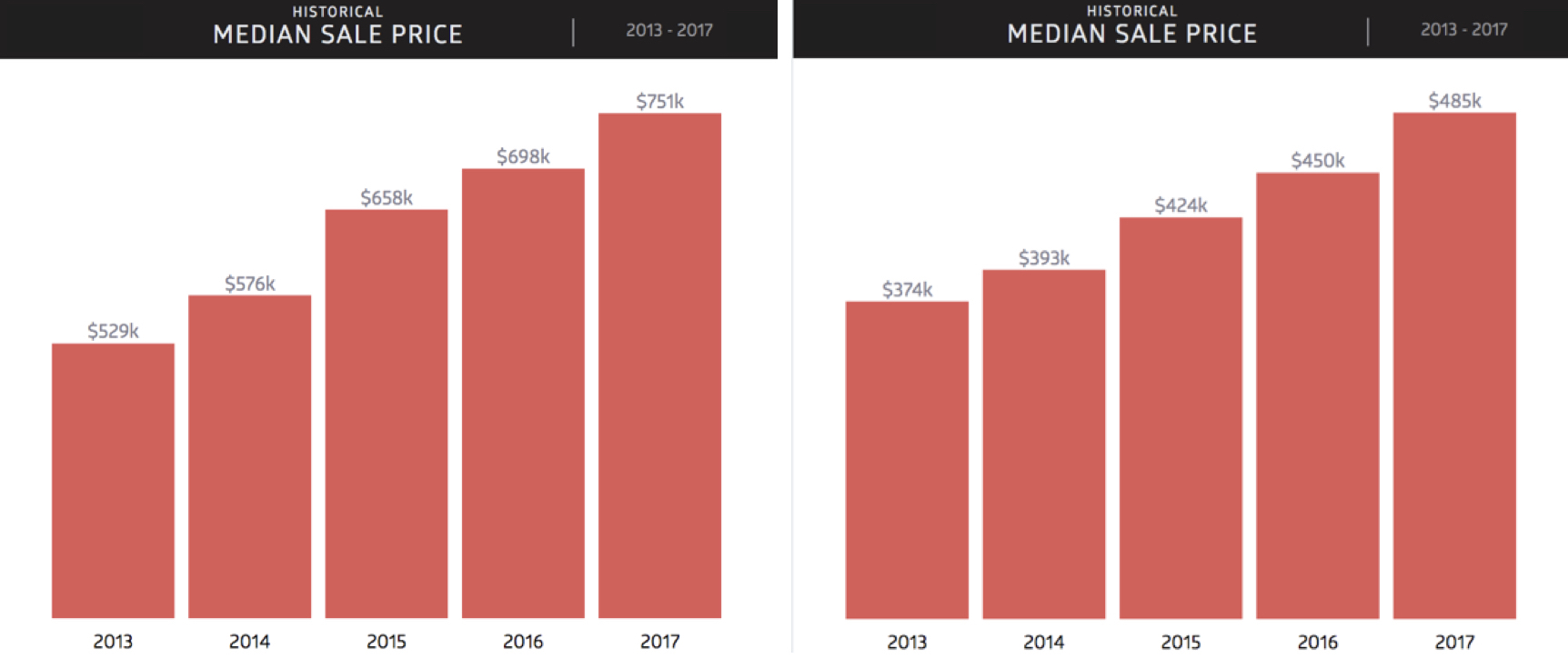

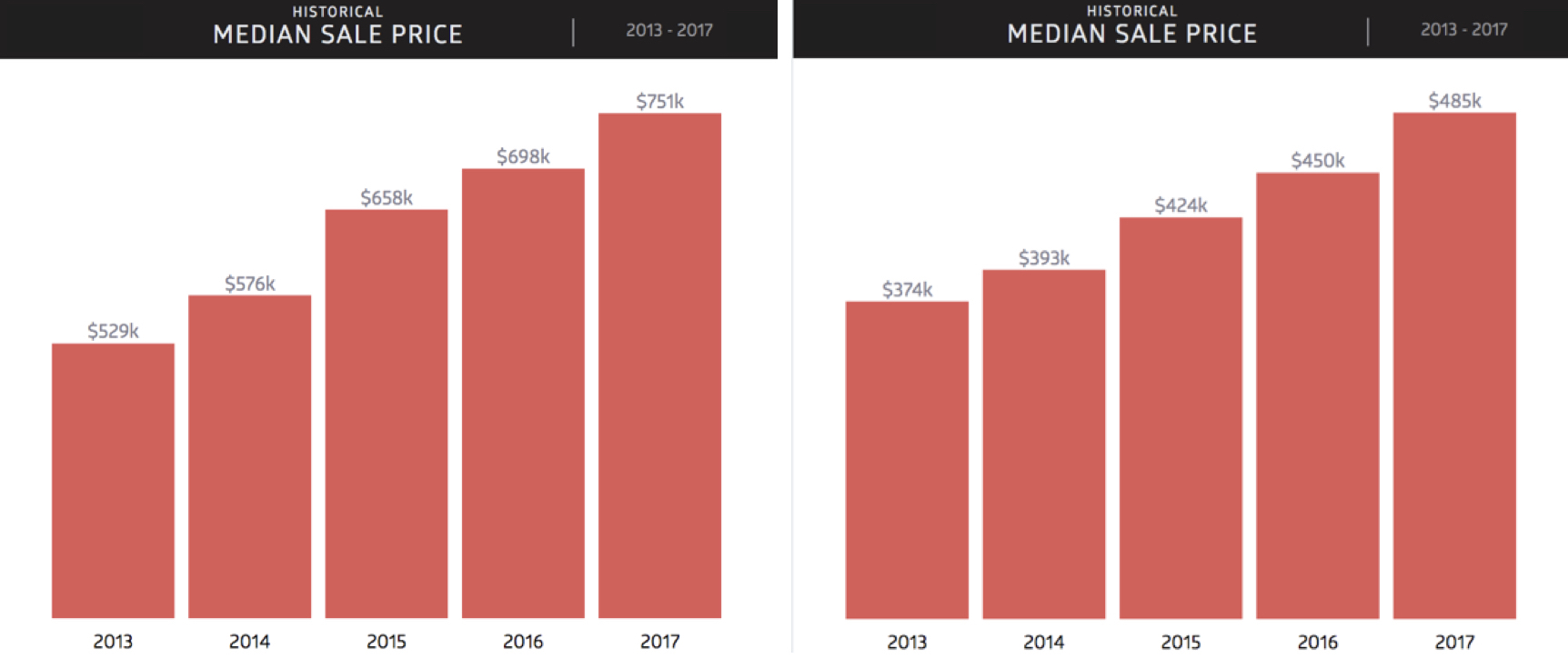

The most reliable markets throughout 2017 occurred in boroughs other than Manhattan. Brooklyn (except in the Heights and some parts of Park Slope where prices are now so high that market behavior parallels that in Manhattan) has seen steady demand and continued multiple bidding throughout the year. As the Long Island City market remains very strong, buyers are looking for value in Astoria, another waterfront neighborhood with easy access to the city center. And the beautiful Art Deco apartment buildings along the Grand Concourse in the Bronx are being brought back to life; rehabilitation and renewal are also sweeping the South Bronx.

Brooklyn | Queens

Luckily the tax changes are no longer a mystery. There will be both burdens and benefits for most of the constituencies we deal with. But with a strong stock market AND lower prices (2017 was one of those interesting years in which these two markets traversed opposite paths), opportunities for serious buyers abound. With high employment and a big Wall Street bonus season on the horizon, I am optimistic about the market for 2018.

Data Source: Perchwell

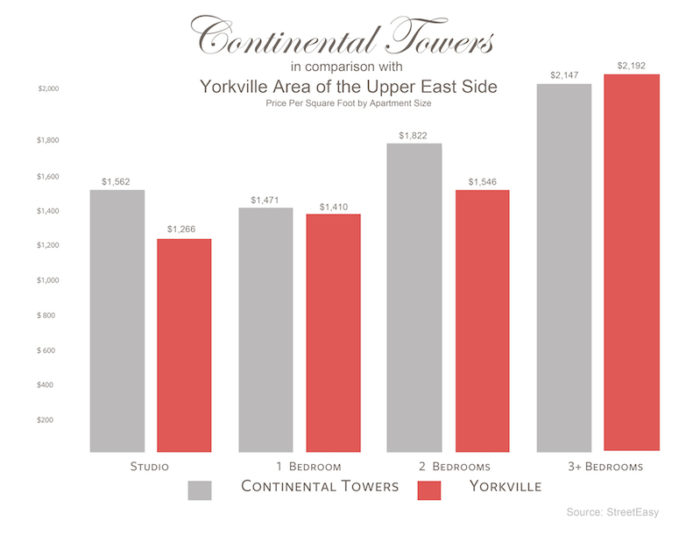

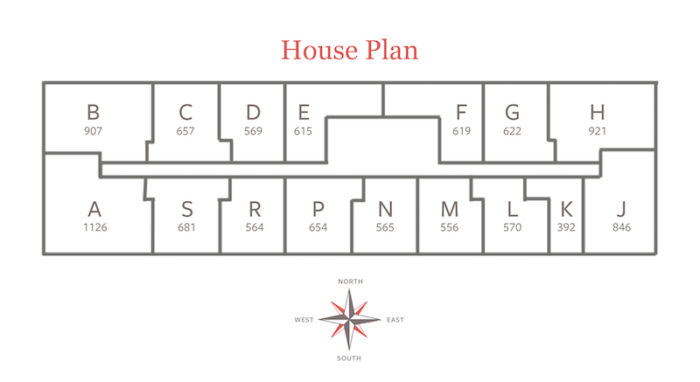

As a Continental Towers resident for over 30 years, i have in-depth knowledge of our building and consistantly monitor our neighborhood trends very closely. I am always available to answer questions about the value of your home and the state of the current market. If you have any questions or would like to schedule a viewing, call or email me.