Warburg’s Monthly Market Update offers a quick snapshot of the active listing metrics compared to the recent historical performance of the target area. This month we focus on Park Slope’s performance through 2018 compared to the currently available inventory in the neighborhoods. Read on for more!

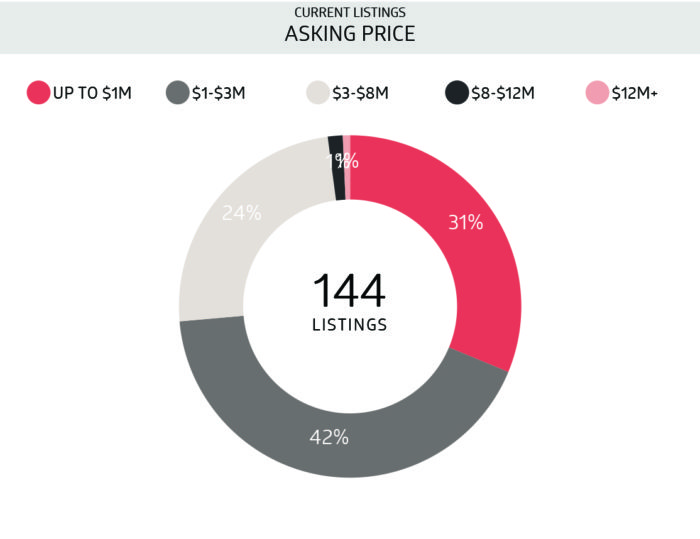

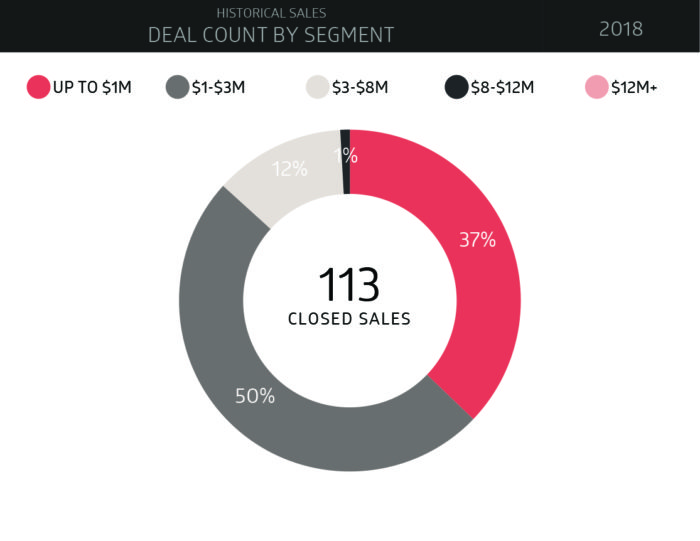

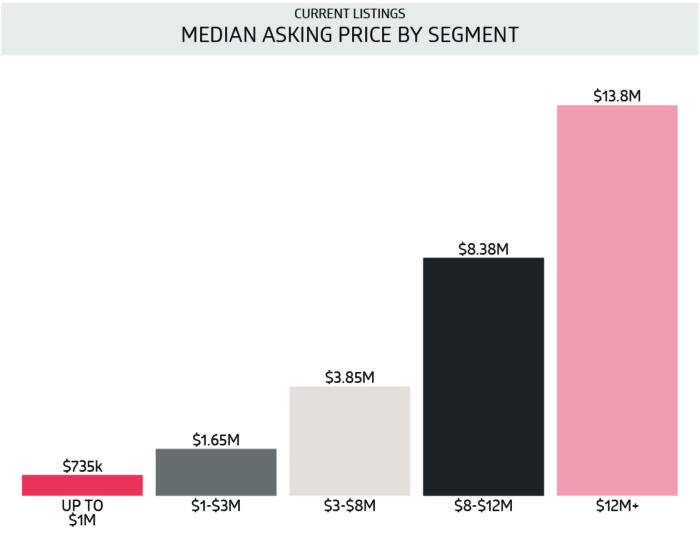

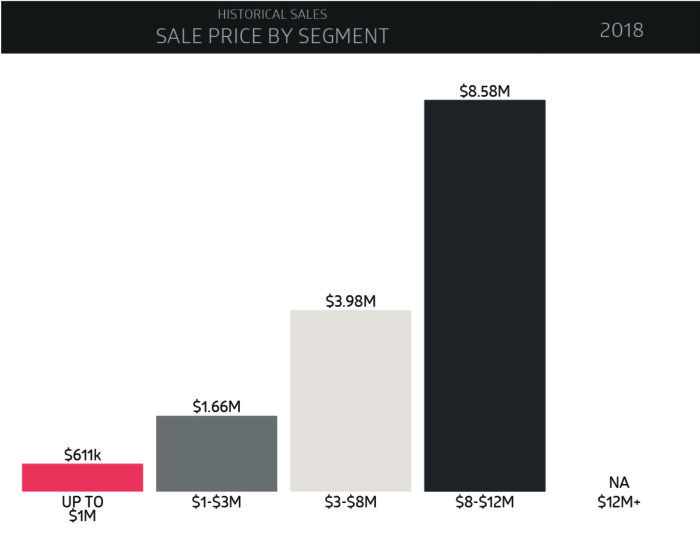

PRICE SEGMENT PREFORMANCE

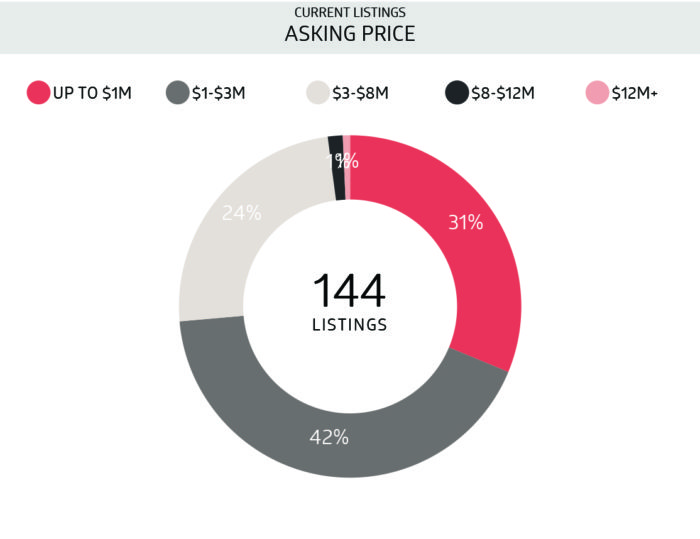

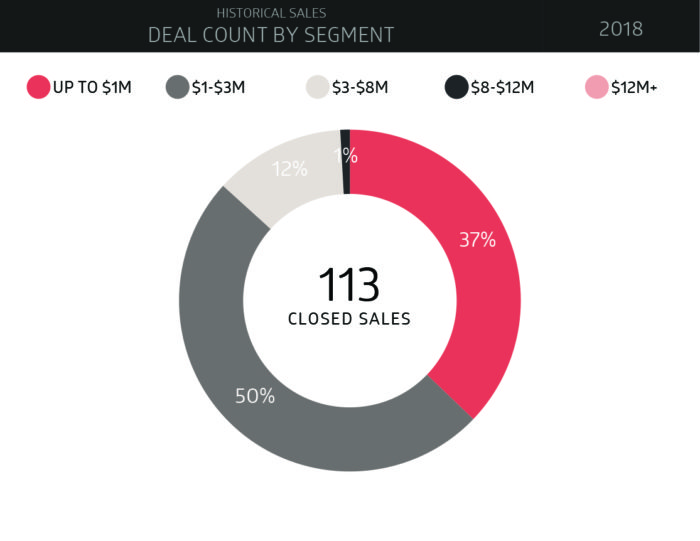

Thus far, in 2018, there have been 113 closed sales transactions in Park Slope. Of these, over 37% were priced below $1 million, and over 50% were priced between $41 million and $3 million. 12% of closed sales were in the $3 to $8 million range, with just 1% of sales surpassing the $12 million threshold. The RLS reports 144 active listings currently on the market, of which 31% are listed below $1 million, 42% are listed between $1 and $3 million, and 24% are listed between $3 and 5 million. The remaining 3% are listed above $8 million.

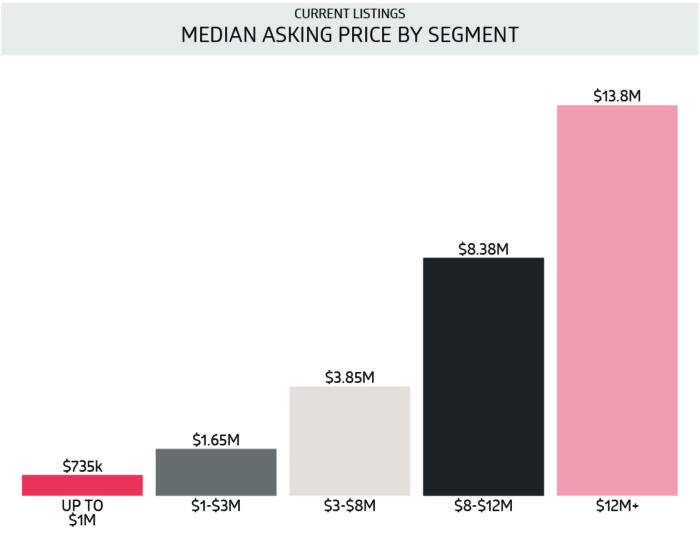

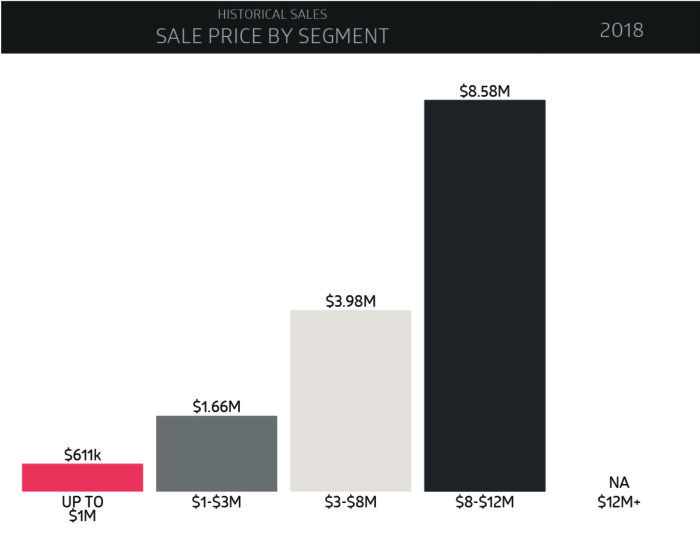

It is worth noting that except for the under $1 million price range, where asking prices are almost 20% higher than the median closed 2018 prices to date, the median asking prices for current listings are below the median close prices across all other price segments, with differences ranging from less than 1% in the $1 to $3 million category, to almost 5% in the $8 to $12 million range.

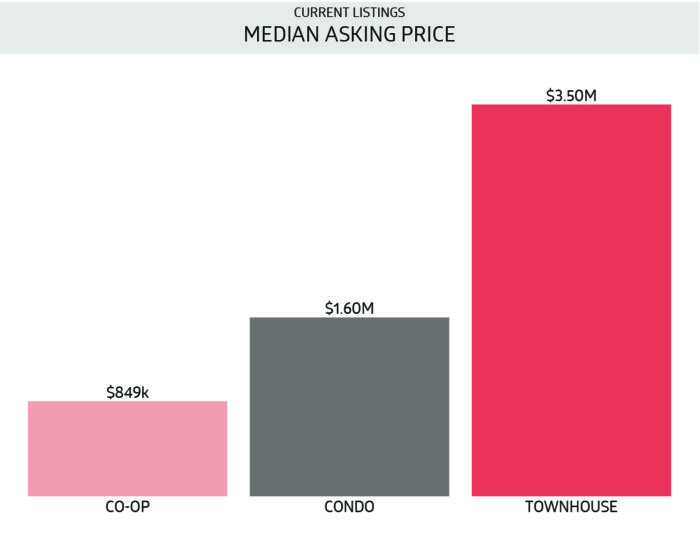

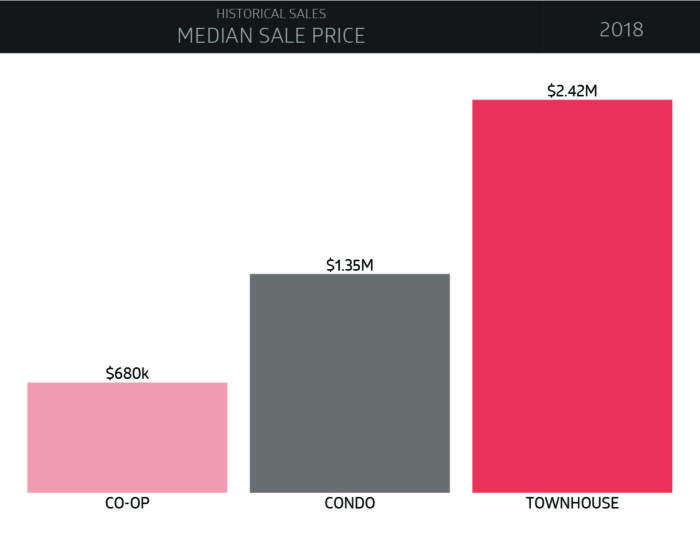

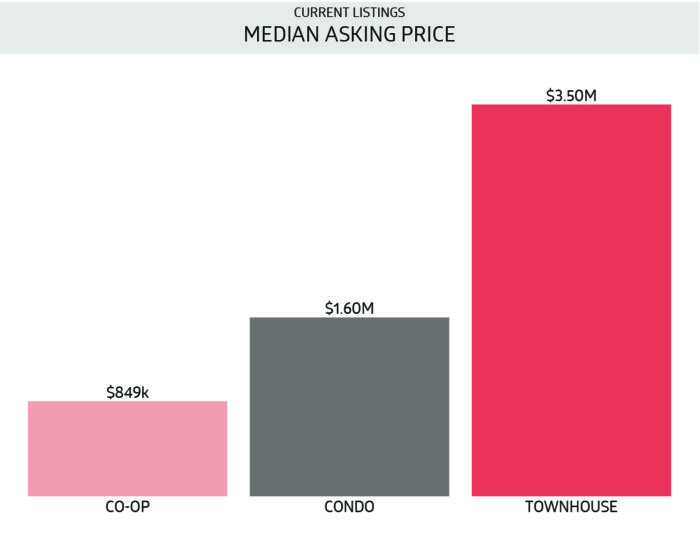

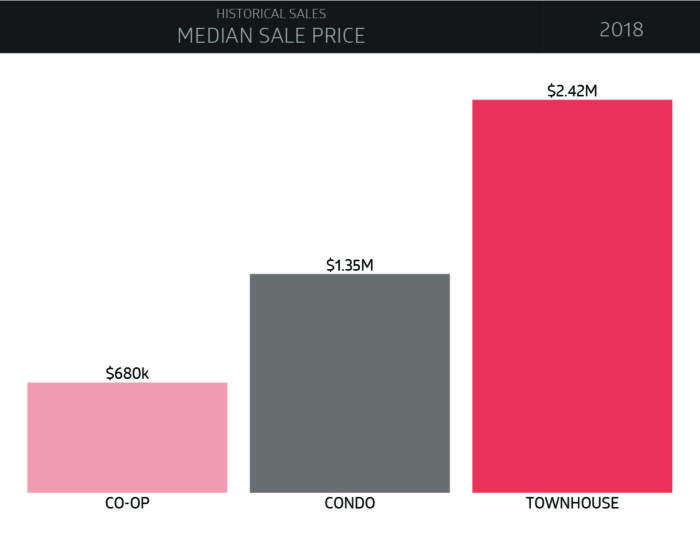

PRICE TYPE PREFORMANCE

A comparison of closed-versus-asking prices across the three main market segments (co-ops, condos, and townhouses) shows that asking prices are consistently higher than closed sales thus far for 2018. The closed sales median pricing in 2018 for townhouses, for example, is $2.42 million versus current median asking prices in this market segment of $3.5 million. Median asking prices for condos are more than 15% higher than closed 2018 sales for the same category. Value remains in the sales of co-ops, where the median asking price, while higher than the median closed prices for 2018, remain significantly lower than median condo prices.